Elon musk stocks to buy

Investing in Elon Musk’s Ventures: Opportunities and Considerations

Elon Musk, the visionary entrepreneur behind companies like Tesla, SpaceX, Neuralink, and The Boring Company, has consistently pushed the boundaries of technology and innovation. For investors, Musk’s ventures present intriguing opportunities. This article delves into the investment prospects associated with Musk’s enterprises, analyzing publicly traded options, potential future offerings, and essential considerations for prospective investors.

Tesla Inc. (TSLA)

Tesla Inc., founded in 2003, has revolutionized the automotive industry with its focus on electric vehicles (EVs), energy storage solutions, and renewable energy products. As of February 15, 2025, Tesla’s stock (NASDAQ: TSLA) is trading at $355.84.

Investment Considerations

• Market Leadership: Tesla maintains a dominant position in the EV market, continually expanding its product lineup and global manufacturing footprint.

• Innovation Pipeline: Ongoing developments in autonomous driving, energy solutions, and AI-driven robotics suggest potential for future growth.

• Competitive Landscape: Emerging competition from traditional automakers and tech companies entering the EV and AI sectors could impact Tesla’s market share.

SpaceX

Elon musk stocks to buy

Space Exploration Technologies Corp. (SpaceX), established in 2002, aims to reduce space transportation costs and enable the colonization of Mars. Notably, SpaceX remains a privately held company, limiting direct investment opportunities for the general public.

Starlink IPO Prospects

Starlink, SpaceX’s satellite internet constellation project, has garnered significant attention. Reports suggest a potential Initial Public Offering (IPO) for Starlink, which could open new investment avenues. As of April 2024, SpaceX was reportedly considering a Starlink IPO, with projections of $10 billion in business for 2024.Â

Neuralink and The Boring Company

Neuralink, focusing on developing implantable brain–machine interfaces, and The Boring Company, aiming to revolutionize urban transportation through tunnel networks, are both privately held entities. Currently, there are no public investment options for these companies.

Indirect Investment Opportunities

While direct investment in SpaceX, Neuralink, and The Boring Company isn’t possible, investors can consider the following approaches:

• Tesla (TSLA): As Musk’s flagship public company, Tesla offers exposure to his innovative ecosystem.

• Virgin Galactic Holdings Inc. (SPCE): For those interested in space exploration, Virgin Galactic provides a publicly traded alternative. As of February 15, 2025, SPCE is trading at $4.37.

Key Considerations for Investors

• Volatility: Stocks associated with high-growth tech companies can exhibit significant price fluctuations.

• Diversification: Balancing investments across various sectors can mitigate potential risks.

• Research: Staying informed about company developments, market trends, and competitive dynamics is crucial.

Conclusion

Investing in Elon Musk’s ventures offers the potential to participate in groundbreaking technological advancements. While direct investment opportunities are limited to Tesla among Musk’s primary companies, staying attuned to developments such as a potential Starlink IPO can provide future avenues. As with any investment, thorough research and consideration of individual financial goals and risk tolerance are essential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult with a financial advisor before making investment decisions.

#ElonMusk #Tesla #SpaceX #Starlink #Investing #StockMarket #Innovation #TechStocks

Keywords: Elon Musk, Tesla stock, SpaceX investment, Starlink IPO, Neuralink, The Boring Company, tech stocks, investing in innovation, stock market opportunities, high-growth investments

Elon Musk, the visionary entrepreneur behind groundbreaking companies such as Tesla, SpaceX, Neuralink, and The Boring Company, has consistently pushed the boundaries of technology and innovation. His ventures span electric vehicles, space exploration, brain-machine interfaces, and urban transportation solutions. For investors, Musk’s enterprises present intriguing opportunities to participate in industries poised to shape the future. This comprehensive article delves into the investment prospects associated with Musk’s companies, analyzing publicly traded options, potential future offerings, and essential considerations for prospective investors.

Tesla Inc. (TSLA)

Founded in 2003, Tesla Inc. has revolutionized the automotive industry with its focus on electric vehicles (EVs), energy storage solutions, and renewable energy products. Under Musk’s leadership, Tesla has expanded its product lineup to include models such as the Model S, Model 3, Model X, and Model Y, as well as energy solutions like the Powerwall and Solar Roof.

Stock Performance and Financial Overview

As of February 15, 2025, Tesla’s stock (NASDAQ: TSLA) is trading at $355.84.

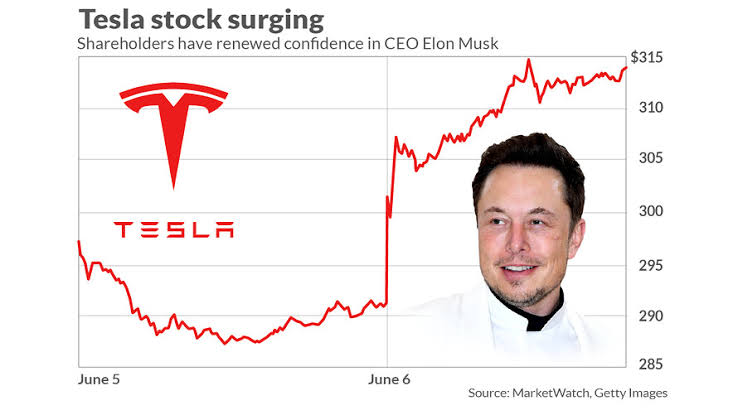

Over the past year, Tesla shares have risen 78%, significantly outperforming broader market indices. This growth reflects investor confidence in Tesla’s diversified technological ambitions and its position as a market leader in the EV sector.

Investment Considerations

• Market Leadership: Tesla maintains a dominant position in the EV market, continually expanding its global manufacturing footprint with Gigafactories in multiple countries.

• Innovation Pipeline: Ongoing developments in autonomous driving, energy solutions, and AI-driven robotics suggest potential for future growth. Notably, Tesla’s advancements in humanoid robots have attracted attention, with plans to ramp up production significantly by 2027.Â

• Competitive Landscape: Emerging competition from traditional automakers and tech companies entering the EV and AI sectors could impact Tesla’s market share. Companies like Meta Platforms and Apple are reportedly investing in humanoid robots, presenting new challenges and opportunities in the tech landscape.Â

SpaceX

Space Exploration Technologies Corp. (SpaceX), established in 2002, aims to reduce space transportation costs and enable the colonization of Mars. The company has achieved numerous milestones, including the development of the Falcon and Starship rocket families and the successful deployment of the Starlink satellite constellation.

Starlink and IPO Prospects

Starlink, SpaceX’s satellite internet constellation project, has garnered significant attention for its potential to provide global high-speed internet access. As of December 2023, SpaceX CEO Elon Musk reiterated that there are no immediate plans for a Starlink Initial Public Offering (IPO), citing the need for a stable and predictable revenue stream before considering going public.Â

This stance aligns with previous statements, where Musk emphasized the importance of financial stability prior to a public offering. While an IPO could offer direct investment opportunities in Starlink, the timeline remains uncertain, with projections extending to 2025 or beyond.Â

Indirect Investment Opportunities

While direct investment in SpaceX is not currently possible due to its private status, investors can consider indirect exposure through partnerships and collaborations. For instance, SpaceX’s collaboration with T-Mobile US aims to integrate Starlink’s satellite internet service to address mobile dead zones, providing connectivity where traditional cellular networks are unavailable. This partnership has positively influenced T-Mobile’s stock performance, offering investors a way to indirectly benefit from SpaceX’s technological advancements.Â

Neuralink and The Boring Company

Neuralink, focusing on developing implantable brain–machine interfaces, and The Boring Company, aiming to revolutionize urban transportation through tunnel networks, are both privately held entities. Currently, there are no public investment options for these companies.

Neuralink’s Progress

Neuralink has made strides in developing brain–machine interface technology, with the goal of enabling direct communication between the human brain and computers. While the company remains private, its advancements could have significant implications for the future of neurotechnology and human augmentation.

The Boring Company’s Initiatives

The Boring Company focuses on creating tunnel networks to alleviate urban traffic congestion. Notable projects include the Las Vegas Convention Center Loop, which provides a glimpse into the potential of subterranean transportation systems. As the company explores additional projects, its impact on urban mobility continues to grow.

xAI: A New Venture in Artificial Intelligence

In addition to his existing enterprises, Elon Musk has ventured into the artificial intelligence sector with the establishment of xAI. This startup aims to develop advanced AI technologies with the potential to transform various industries.

Investment Prospects

As of February 2025, xAI is reportedly discussing a $10 billion fundraising round, which would elevate its valuation to $75 billion. This follows previous funding rounds totaling $12 billion in 2024, with investors like Sequoia Capital, Andreessen Horowitz, and Valor Equity Partners involved in these discussions.Â

While xAI remains a private entity, its rapid valuation growth and significant capital raises indicate strong investor interest in the AI sector. Potential future public offerings could provide direct investment opportunities as the company matures.

Indirect Investment Opportunities

While direct investment in SpaceX, Neuralink, The Boring Company, and xAI isn’t currently possible, investors can consider the following approaches:

• Tesla (TSLA): As Musk’s flagship public company, Tesla offers exposure to his innovative ecosystem, including advancements in AI and robotics.

• T-Mobile US (TMUS):

Pingback: Hurry Elon Musks AI Grok 3: Redefining Human Understanding Through Artificial Intelligence - KIK it OFF

Pingback: Unveiling the Enigmatic Legacy of Errol Musk: The Complex Journey Behind Elon Musk’s Father Must Read - KIK it OFF

Pingback: Top 10 Richest People and Their Empires - KIK it OFF

Pingback: The Ultimate Guide to the iPhone 16e: Rumors, Price, Features, and Upcoming Apple Announcements - KIK it OFF

Pingback: Elon Musk Small Business Empowerment: Revolutionising Local Economies Through Innovation 1 - KIK it OFF